First Published on 18th May, 2023

The Adani-Holcim deal where the Adani group will acquire Holcim’s Indian assets for $10.5 billion is pegged to be India’s largest-ever merger and acquisition transaction in the infrastructure and materials space. In this deal, Adani will acquire ~63% stake in Ambuja Cements and ~55% stake in ACC both being Indian listed companies.

Holcim’s CEO in his address to investors mentioned that this deal is likely to be tax free for Holcim.

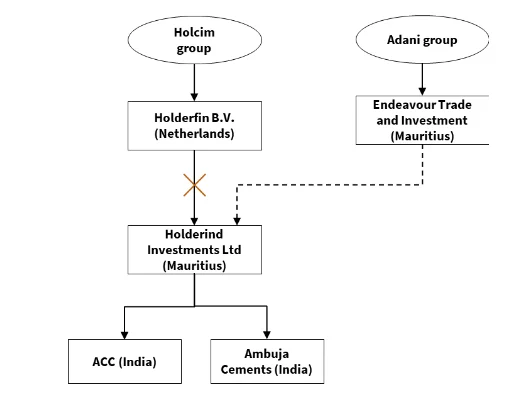

Before discussing whether gains arising to Holcim will be tax free or not, it would be key to first understand the facts (as per publicly available information):

- The selling entity is likely to be Holcim’s Dutch investment company which holds investment in Holcim’s investment company in Mauritius.

- This Mauritius investment company, in turn, holds stake in Ambuja Cements and ACC.

- The Dutch company will sell the shares in the Mauritius investment company to Adani’s Mauritius based investment company.

- To represent this diagrammatically,

This seems to be a classic case of “indirect transfer” i.e. transfer of shares of foreign entities owning shares / assets in India instead of a direct transfer of such Indian shares / assets.

Indian tax treaties with Mauritius, Singapore, Netherlands, etc continue to have a capital gains tax exemption for such indirect transfers of Indian shares. In other words, as per these treaties, capital gains arising on sale of shares of a non-Indian entity are taxable only in the country in which the seller is a resident i.e. in Mauritius / Singapore / Netherlands.

Applying the above mentioned laws to the facts of this deal, considering that even though substantial value of Holcim’s Mauritius company arises from assets located in India (i.e. Ambuja Cements and ACC), India may not be entitled to collect tax on the gains arising on this transaction as per the India-Netherlands tax treaty.

We Are Problem Solvers. And Take Accountability.

Related Posts

India’s Budget 2026 – Data Centres, IT, Tech & Global AI

Union Budget 2026–27 signals a decisive strategic pivot: India is moving from being a consumer and services executor of global...

Learn More

Proposed LLP Act Tweaks and Impact on AIF Structures in India

Proposed amendments to the LLP Act, 2008 signal a policy push to allow more Alternative Investment Funds to operate through...

Learn More

CBDT released Draft Income-Tax Rules, 2026 – Details & Insights

India is entering a decisive phase of direct tax reform with the Income-tax Act, 2025 scheduled to come into force...

Learn More