Quick Summary

In the 2024 Union Budget, the Indian government introduced a significant amendment to the Foreign Exchange Management Act (FEMA) (Non-debt Instruments) Rules, 2019, facilitating Foreign Direct Investment (FDI) and Overseas Direct Investment (ODI) swaps. This provision allows investors to exchange their FDI in Indian entities for ODI in foreign entities, streamlining cross-border investment processes. Key changes include the exclusion of investments by Overseas Citizens of India (OCIs) on a non-repatriation basis from indirect foreign investment calculations, removal of the 49% aggregate cap on Foreign Portfolio Investors (FPIs), and the recognition of ‘White Label ATM Operations’ as a new sector with 100% FDI permitted. These reforms aim to enhance investment flexibility and attract more global investors to India’s evolving financial landscape.

Blog Content Overview

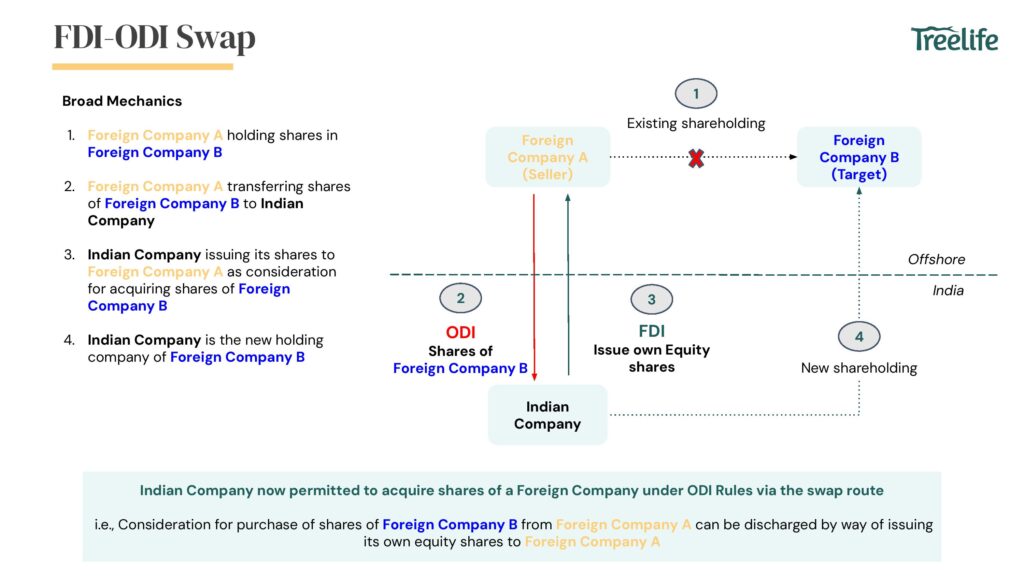

Following the recent budget announcement, which aimed to simplify regulations for Foreign Direct Investment (FDI) and Overseas Investment (ODI), the Department of Economic Affairs has amended the FEMA (Non-debt Instruments) Rules 2019. A significant aspect of this amendment is the introduction of a new provision that enables FDI-ODI swaps. We have curated a slide below to help you understand this better.

Broad Mechanics

- Foreign Company A holding shares in Foreign Company B.

- Foreign Company A transferring shares of Foreign Company B to Indian Company.

- Indian Company issuing its shares to Foreign Company A as consideration for acquiring shares of Foreign Company B.

- Indian Company is the new holding company of Foreign Company B.

Indian Company now permitted to acquire shares of a Foreign Company under ODI Rules via the swap route.

i.e., Consideration for purchase of shares of Foreign Company B from Foreign Company A can be discharged by way of issuing its own equity shares to Foreign Company A.

𝘖𝘵𝘩𝘦𝘳 𝘢𝘮𝘦𝘯𝘥𝘮𝘦𝘯𝘵𝘴:

1. Investment by OCIs on non-repat basis 𝐞𝐱𝐜𝐥𝐮𝐝𝐞𝐝 from calculation of indirect foreign investment. Earlier only NRI investment was excluded.

2. Aggregate FPI cap of 49% of paid-up capital on a fully diluted basis has now been removed. FPIs now required to 𝐨𝐧𝐥𝐲 𝐜𝐨𝐦𝐩𝐥𝐲 𝐰𝐢𝐭𝐡 𝐬𝐞𝐜𝐭𝐨𝐫𝐚𝐥 𝐨𝐫 𝐬𝐭𝐚𝐭𝐮𝐭𝐨𝐫𝐲 𝐜𝐚𝐩.

3. ‘White Label ATM Operations’ has been recognized as a new sector, with 100% 𝐅𝐃𝐈 𝐧𝐨𝐰 𝐚𝐥𝐥𝐨𝐰𝐞𝐝 𝐮𝐧𝐝𝐞𝐫 𝐭𝐡𝐞 𝐚𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐜 𝐫𝐨𝐮𝐭𝐞.

Key Indian players in this sector: India1 Payments, Indicash ATM (Tata Communications), Vakrangee, and Hitachi Payments.

4. NR to NR transfer will require prior Govt approval 𝐰𝐡𝐞𝐫𝐞𝐯𝐞𝐫 𝐚𝐩𝐩𝐥𝐢𝐜𝐚𝐛𝐥𝐞. In the erstwhile provisions, it was required only if investment in the specific sector required prior Govt approval.

5. Definitions – Control now defined in Rule 2, and definition of “startup company” has been aligned with “startups” recognised by DPIIT vide notification dated February 19, 2019. Definitions of “control” and “startup company” elsewhere have been deleted.

We Are Problem Solvers. And Take Accountability.

Related Posts

India’s Budget 2026 – Data Centres, IT, Tech & Global AI

Union Budget 2026–27 signals a decisive strategic pivot: India is moving from being a consumer and services executor of global...

Learn More

Proposed LLP Act Tweaks and Impact on AIF Structures in India

Proposed amendments to the LLP Act, 2008 signal a policy push to allow more Alternative Investment Funds to operate through...

Learn More

CBDT released Draft Income-Tax Rules, 2026 – Details & Insights

India is entering a decisive phase of direct tax reform with the Income-tax Act, 2025 scheduled to come into force...

Learn More